Being subject to quite a lot of regulation already, there are some new rules about disclosing charges to clients being introduced in January 2018 that I am really looking forward to.

After an investigation, the Financial Conduct Authority has criticised a lot advisers and wealth managers recently for not disclosing their charges properly, hence the new rules. The advice given was largely okay, but they were caught trying to flog as many products as possible and hiding their charges for doing so. I don’t like that and thankfully neither do the FCA.

We charge fees that are nearly always fixed amounts in pounds and pence both to become a client and each month thereafter. We are very open and transparent about this. Adrian and I are very cost conscious (some may say tight-fisted!) and Chatfield is a lean and efficient business meaning our fees compare well against our peers. We are also strong advocates of low-cost, evidence-based investing.

Nearly all our fellow IFAs charge a percentage of the value of the assets managed, usually towards the higher end between 0.5% and 1% p.a., which is a perfectly acceptable approach.

My biggest criticism of the percentage approach is that most people don’t realise how much this translates into in cold, hard cash, as per the following conversation I had last year:

Me: “…and our fees for that will be £200 per month.”

Mr A: “But I only pay my existing adviser 0.75% p.a.”

Me: “I know, and that’s around £235 per month.”

Mr A: “Is it? I never realised that…”

From January 2018 and every 12 months thereafter, investors will have to be told in crystal clear terms all the charges they have incurred in the last year in both %%% and £££ in a statement all on its own, not buried in the small print on the last page hoping it won’t be noticed.

This will need to be absolutely every single charge incurred. This is wonderful news to me, because at present it is a scandal that not all charges are legally required to be disclosed and I think most investors have no idea how much their charges add up to.

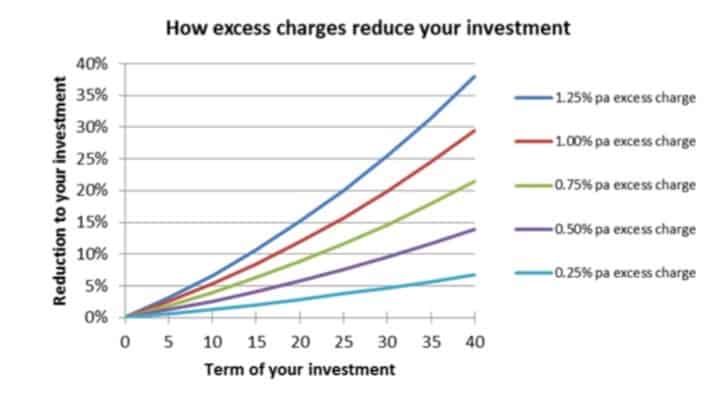

What difference do charges make? More than you think:

Charges vary widely though a lot of well-known wealth management firms can easily have total costs of 3.5% p.a.

“Wait!” I hear you cry. “These firms employ the very best people who are so clever they outperform the market so the fees are worthwhile.”

Oh dear. I’m sorry to say there is absolutely no evidence for that whatsoever. Contrary to other walks of life, with investing you rarely get what you pay for.

The detail on that is an argument for another day. For now, I’m looking forward to people realising from January 2018 what their pensions and investments cost and pondering whether that is good value or not.

Live long and prosper

Philip Challinor Director