I’m only watching the news in the morning so I have the rest of the day to work, do some exercise and generally be as positive as I can. I’m avoiding watching the news in the evening as it’s so easy to go to lie in bed afterwards wide awake pondering on the dreadful state of the world.

I’ve had various reactions from clients in recent weeks ranging from…

“This is going to get a lot worse before it gets better”

“It could be two to three years before the world returns to normal”

“The world may not return to normal during my lifetime”

…all the way to:

“This is one amazing buying opportunity!”

Through millennia of evolution, us human beings have been hardwired to spot danger so we can avoid it. Sabre tooth tigers and scary financial markets are both types of danger we seek to avoid.

It’s easy to get dragged into the negativity of the financial markets. Oil around $25 barrel, the FTSE100 close to 5,000, the Dow Jones close to 20,000, global stock markets down 25%…

A significant contributor to successful investing is psychological. This is really being tested now and the three key attributes here are discipline, discipline and discipline.

To keep it brief, I have two key thoughts for you.

- To reduce risk, you should have investments other than shares, e.g. bonds, property and cash.

- When will markets recover? Nobody knows. My best answer is in the past, given time, they have ALWAYS recovered.

To elaborate on each of the above:

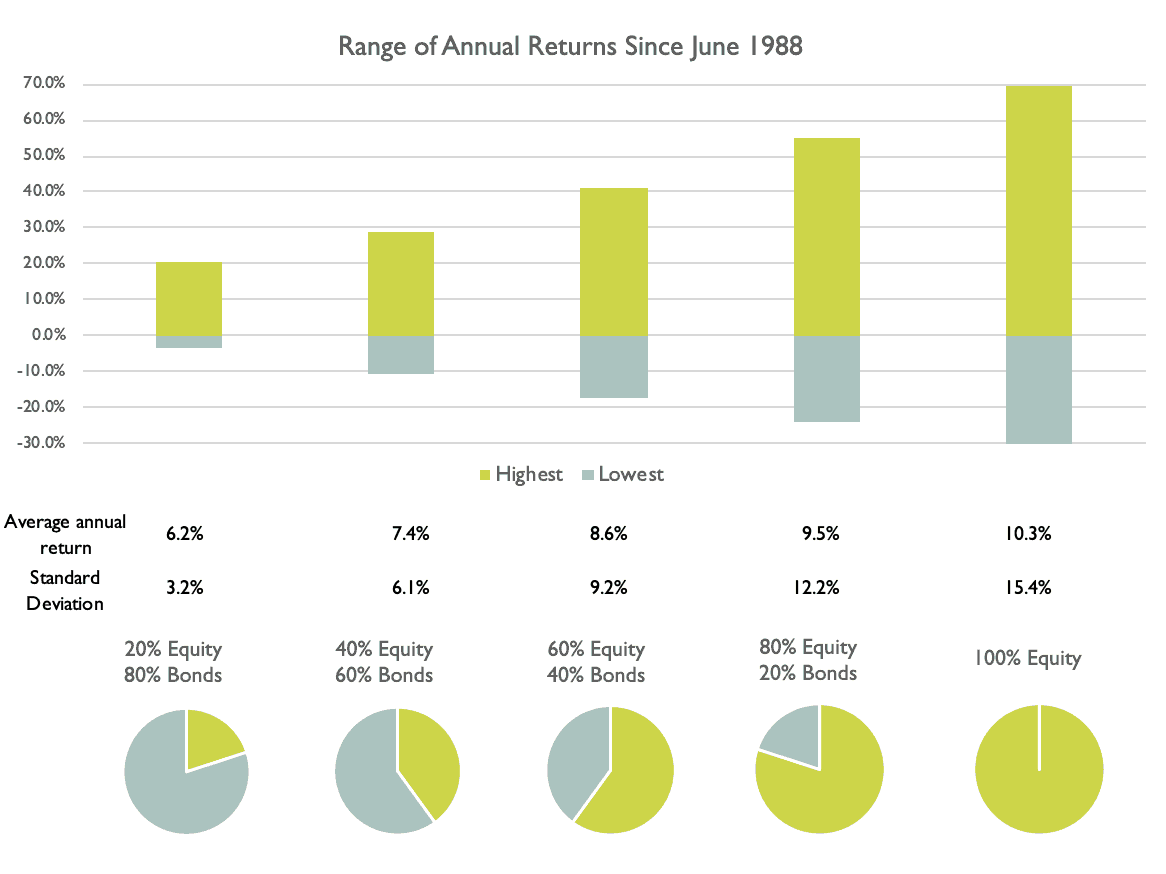

By all means invest in the stock market. But the fluctuations of the markets if you 100% invest in shares will be such a psychological test you will be constantly nervous. Instead hold a percentage you are comfortable with in shares and the rest in much lower risk government bonds. The two have historically worked well together and will smooth out the turbulence of the stock markets.

As you can see below, the more risk you take the more money you have historically made, but then you could lose more too. There is no right or wrong answer here, it’s all about balance and your own unique circumstances.

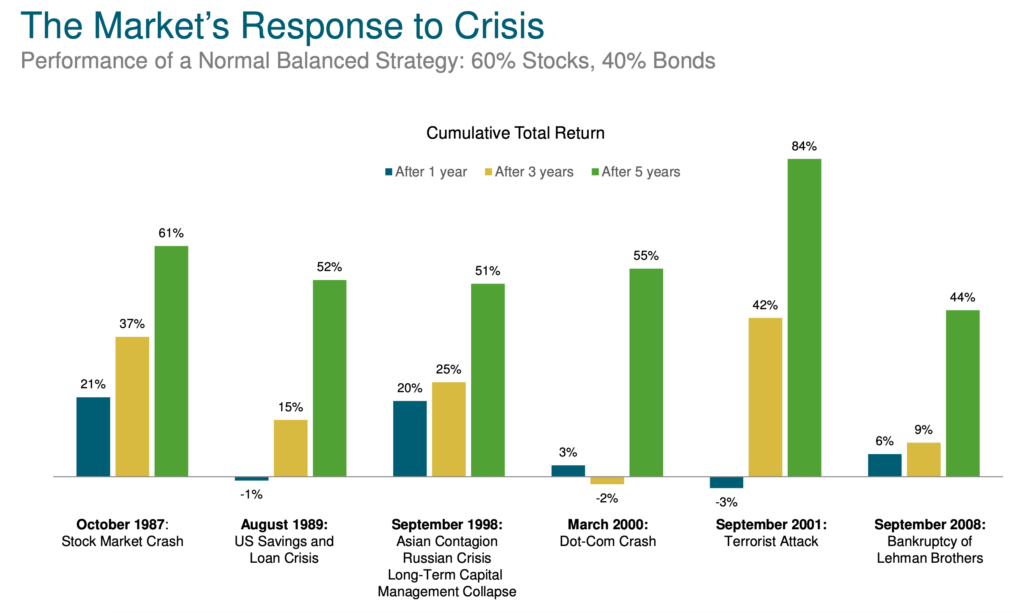

Secondly, this too shall pass, it’s just uncomfortable because nobody knows when. Markets have always recovered and rewarded patient, long-term investors. I know it feels uncomfortable right now, but the chart below shows how a portfolio only 60% invested in shares has recovered after previous crises:

Remember:

- This too shall pass

- Be disciplined

- Be rational

If you are in any way concerned about your current financial situation, just pick up the phone and call either me or Adrian